For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application.

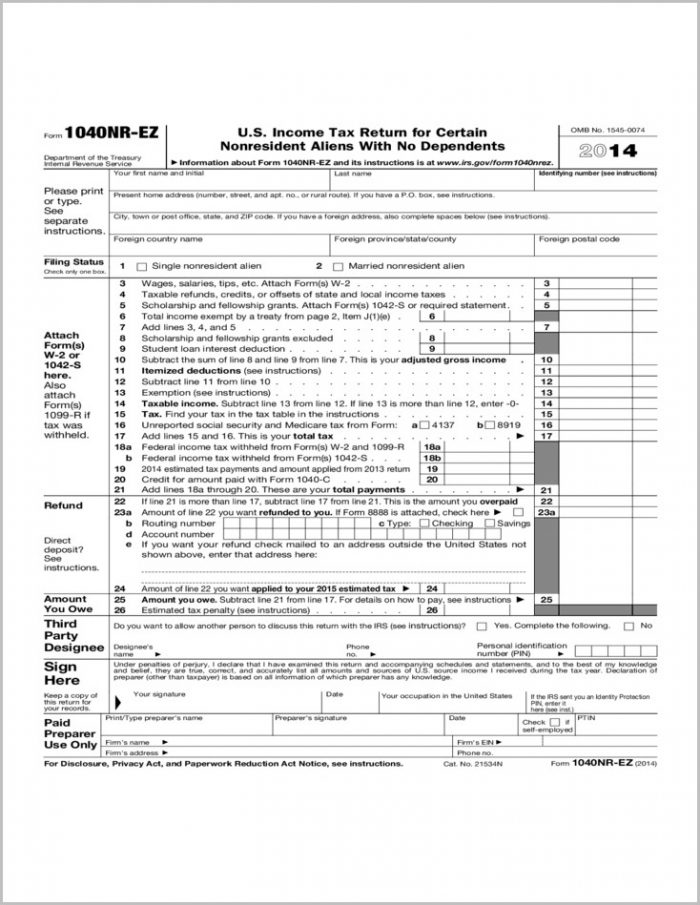

We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. Retrieved January 23, 2023.This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Department of the Treasury, Internal Revenue Service. Please report any broken 1040A form and instructions booklet links using our contact us page found at the bottom of this page. If you filed Form 1040A in prior years, then you will use the redesigned IRS Form 1040 for the current year. These free PDF files are unaltered and are sourced directly from the publisher.įorm 1040A was discontinued by the IRS beginning with the 2018 income tax year. Printable Form 1040AĬlick any of the IRS 1040A form links below to download, save, view, and print the file for the corresponding year. If you do not meet the above requirements, go to Form 1040.

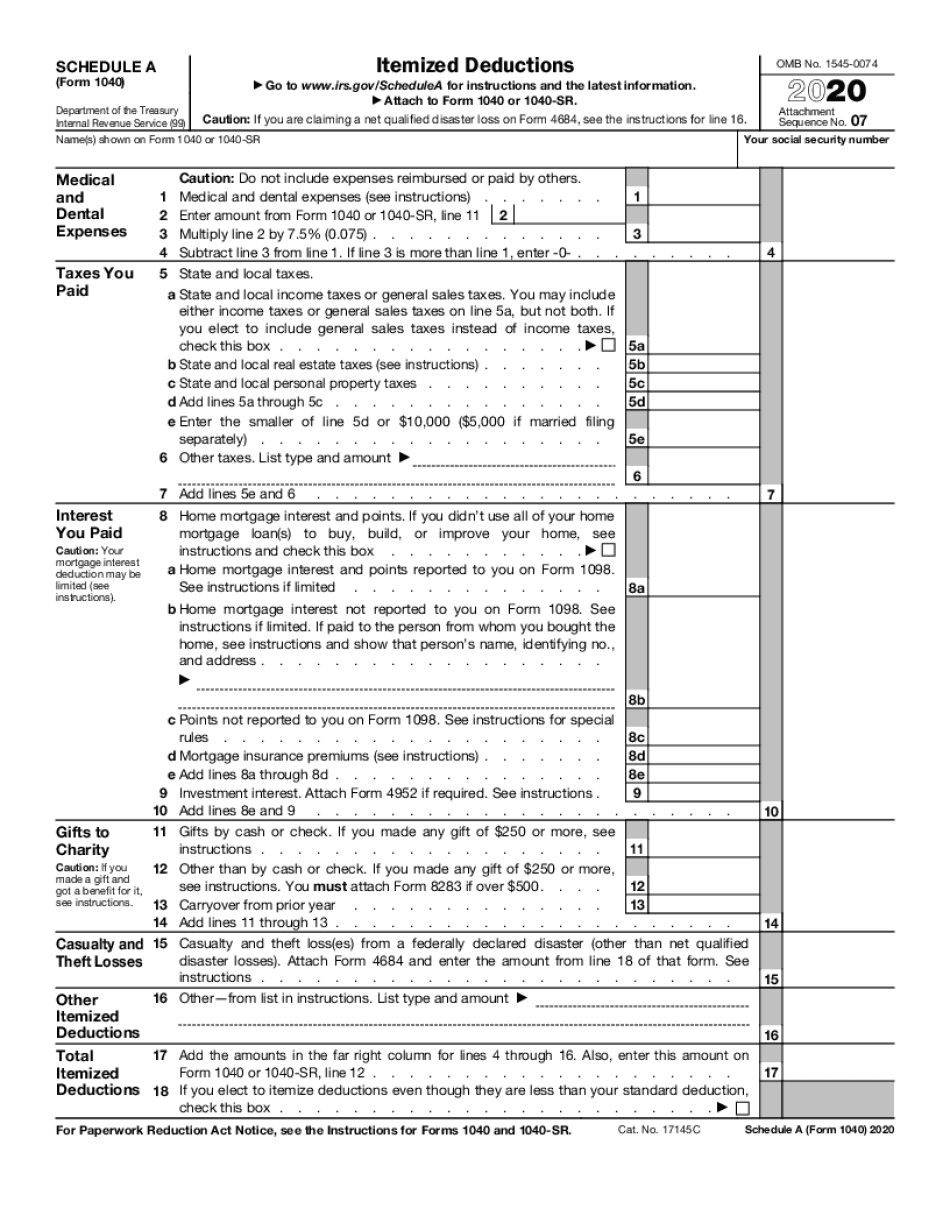

Credits for child and dependent care expenses, elderly or the disabled, education, earned income credit (EIC), adoption, and retirement savings contributions are allowed.Educator expense, IRA deduction, student loan interest, and tuition and fees gross income adjustments are allowed.No alimony income received or alimony paid.No rental, royalty, partnership, S corporation, or trust income.No business income or loss, self-employed, LLC, etc.No capital gain or loss, no other gains or losses.No itemized deductions, mortgage interest, property tax, etc.File Form 1040A if you meet these requirements:

0 kommentar(er)

0 kommentar(er)